Protecting the business from risks and rash steps is what the head of every large company thinks about. Cooperation with unproven brands or clients can not only ruin the reputation but also cause irreparable damage. That’s why many people use the KYC principle ("know your customer"), which helps to get the necessary information about the company with which you cooperate. It is used by banks, stock exchanges, and betting companies.

KYC is a principle that says that the parties must identify themselves before they carry out a transaction. In this way, companies try to better understand their own clients. They get the right to monitor transactions which helps in:

- reducing the risks to the customers themselves;

- the prevention of bribery;

- the possibility of regular monitoring of financial transactions.

Thanks to KYC, companies can monitor all risks and costs. For example, banks learn complete information about their clients. It includes passport data, information about assets, salary, and other information. So, banks can be sure that they are not dealing with a fraudster. Such procedures are widespread not only in financial institutions but practically in all spheres of business.

However, now the security requirements are becoming even more stringent. Therefore, to keep your business safe and transparent, you need KYCAID system checks.

Going from classic KYC to a holistic compliance system

Classic KYC allows you to find out a lot of information about the client, but in modern conditions, this is often not enough. For example, the fact that companies do not know the origin of funds remains a problem. Therefore, they can work with illegally obtained assets. Naturally, in the future this may lead to sanctions, blocking of activities, or real criminal punishment.

The problem lies in the fact that many work with illegal funds without even knowing it. Many organizations are not interested in where the assets were obtained from, for them, it is not so important. However, in modern conditions, business representatives should be more responsible. Brands that intend to be transparent need to understand where certain funds come from.

As a result, if firms receive information about the client, then only partial. This is not enough to understand with whom exactly the company cooperates, whether such a client can be considered reliable, trust him in the future.

What is the purpose of KYCAID?

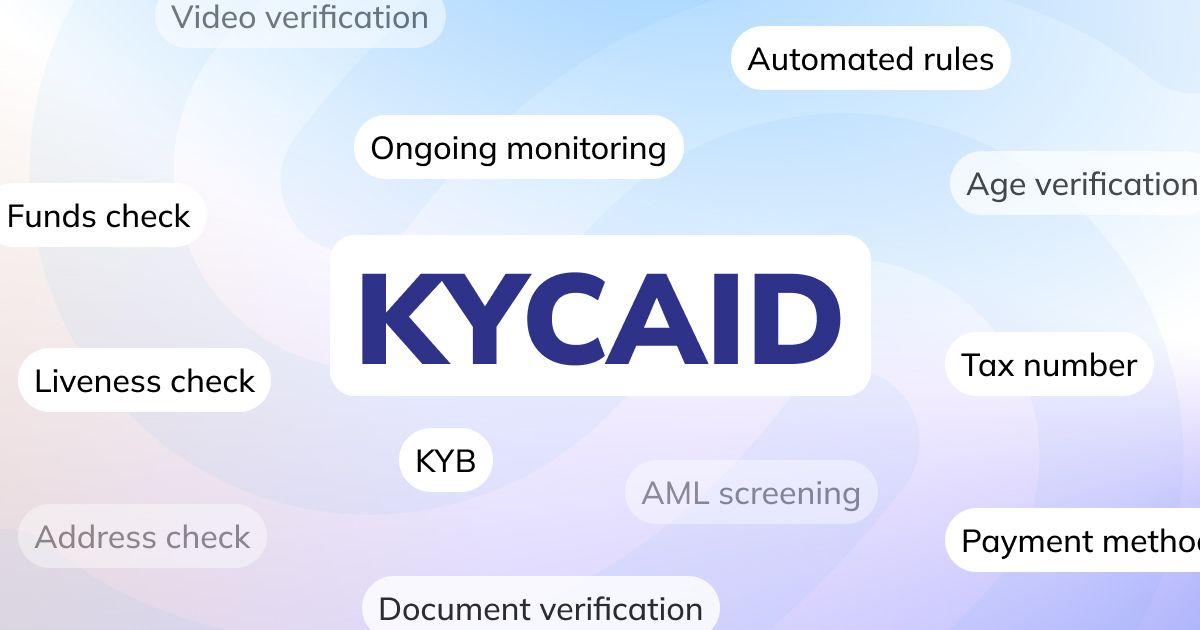

KYCAID is a comprehensive method that will solve problems in many popular business areas. We offer an online identification service. It passes automatically within a few seconds, and human intervention is minimized. This eliminates the factor of error or inaccuracy.

If the system determines that a potential partner is involved in money laundering, then you will receive appropriate notification. The company will be safe and you will not make unwanted deals.

KYCAID significantly reduces the risk of working with an unwanted organization. You will gain confidence in your business partner and will enter into exceptionally profitable agreements.

Main functions of KYCAID

KYCAID is a platform that offers fast business solutions. Thanks to intelligent data, it will be possible to prevent working with organizations or clients that are involved in money laundering. As a result, operations will be transparent and understandable.

The main functions can be called:

- Verification of the legitimacy of transactions. KYCAID allows you to make sure that your partner really receives his funds legally. Checking and verification services are clear and extremely fast. all you need to do is go through the identification procedure. It takes just a couple of minutes.

- Risk reduction. The procedure involves not only classic KYC, but also AML. Audits can be carried out in almost any area of business. On our platform, there is always an individual approach. This allows you to solve problems that will increase the efficiency and security of your business.

- One-step solution for corporate verification. We offer a procedure that involves checking the work of responsible persons and representatives of the company you are going to cooperate with. Such an operation will ensure that the funds were obtained legally and the potential partner was not involved in fraudulent activities.

Also, do not forget about automated verification and KYB compliance. Compliance through Know Your Business is a very time-consuming process. At the same time, it must be carried out constantly so that there are no questions regarding the legality and security of all transactions.

To pass KYB, companies are required to:

- You need to provide documents that confirm the name, address, and date of the foundation. The more data, the more likely it is to get reliable results.

- The presence of sanctions. It is revealed whether one of the founders was involved in various frauds.

- Check in the media. It turns out where and how the company is mentioned. This will reveal what kind of reputation it has, and whether it can be considered a potential reliable partner.

- Recipient verification. It allows you to identify his possible connection with illegal organizations or learn about tax evasion.

- Verification of an authorized person. The analysis of information about a person who has the right to sign official documents is carried out.

- Checking open registers. The information in them is checked 2 times. This allows you to understand how active the company is and whether it can be trusted.

All these procedures help protect and secure your business. Thanks to KYCAID, it will be possible to be 100% sure that cooperation with the other party is safe.

What are the pros of using KYCAID?

The use of the compliance agent is what all companies are interested in, which count on stable development and increasing the audience of consumers. The main advantages of this are:

- Maintaining customer compliance. The use of modern technologies and a thorough check will allow you to determine whether you have any doubtful funds left in your account. If there is any suspicion of money laundering, you will certainly be informed. Doing business with such companies is dangerous. In addition, it can negatively affect the reputation and raise questions from law enforcement agencies.

- Attracting new customers who will not have problems with reputation. This will allow you to develop your business, and find new markets. The company will work legally, which will allow it to develop systematically and reach a new level.

- Possibility of comprehensive identity verification with the KYCAID platform. It will allow you to learn the necessary information about the activities of the company or a particular client. The information concerns both personal information and sources of funds. You will not deal with scammers. This will allow you to develop your business and attract only reliable partners.

Thanks to KYCAID, business risks are reduced. This is especially important when many brands and customers regularly enter the market. If in the past it took a lot of time to verify their reliability, to obtain data, now it is much easier to find out such information.

Thus, be sure to contact our company and innovative solutions will be organized for your business that will prevent fraud and bring the level of income to a qualitatively new level.