International and local legislation across countries and governments have to constantly issue new regulations due to common cases of underaged users getting access to NSFW content, making forbidden payments, and spawning other issues of that sort.

In the sphere of adult content, regulations vary a lot depending on the country.

Some countries strictly prohibit adult content, some need a VPN to be used, and definitely age restrictions apply.

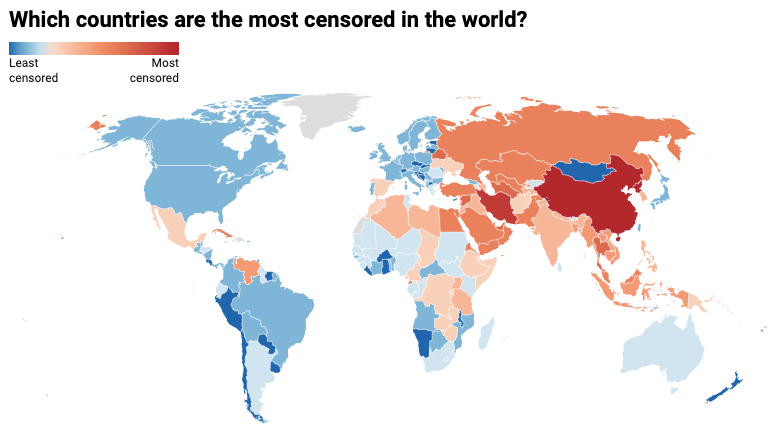

Here is a map of Countries Where NSFW Is Illegal or limited (2022).

You can read more about restrictions in different countries here.

Restrictions should be researched and implemented depending on the countries of operations of your company. And first of all age verification processes must restrict access for minors.

How does it work here?

Kycaid provides a reliable method to prove age by extracting the date of birth from the ID provided by the applicant. We verify the documents' legitimacy, the personality of the applicant, age, and country of residence, and assure that the documents provided are genuine. By means of liveness or video verification, we provide you with a score based on how similar the two faces are.

It ensures that minors aren’t simply presenting someone else's document.

By means of payment method verification, we protect our customers from financial operations with theft or lost credit cards. Comparing the owner's data on the credit card with the ID data is extra security as well.

In case our specialists doubt the legitimacy of documents, additional checks are carried out. Data from documents in various registers is extracted and compared with the documents provided by clients. All applicants are checked through international and local databases of restricted persons to keep our clients safe from fraudsters and comply with AML standards.

For more information on how to adjust a KYC flow for your business, please